Why Your LLC or Corporation Won’t Save You—And What Will

If you own and operate a restaurant in New York, your LLC or corporation does not protect your personal assets from wage and hour claims. This is the single most significant source of personal liability for restaurant owners today—and it’s exactly why irrevocable trusts have become an essential planning tool for operators who want to protect what they’ve built.

The restaurant industry is ground zero for wage and hour litigation. When claims turn into lawsuits, the damages are staggering—and under both federal and New York law, you are personally liable, not just your business entity. This article explains the exposure and shows you how irrevocable trusts can shield your personal assets before a claim ever arises.

The Problem: Personal Liability You Can’t Structure Around

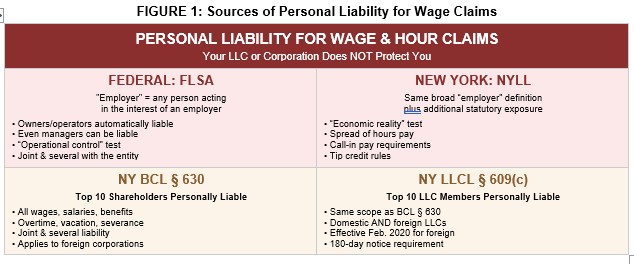

Under the Fair Labor Standards Act, you are personally an “employer” if you exercise operational control over your restaurant—and you’re jointly and severally liable for wage violations. New York law goes further: BCL § 630 and LLCL § 609(c) make the top ten shareholders or members personally liable for all unpaid wages, regardless of fault. Delaware incorporation doesn’t help—these statutes apply to foreign entities too.

The damages add up fast: back wages (six years in New York), doubled as liquidated damages, plus interest and attorneys’ fees. A modest underpayment across your workforce can easily become six-figure personal exposure. And because these claims are against you personally, your house, savings, and investments are all at risk.

The Solution: Irrevocable Trusts

If you cannot prevent personal liability for wage claims, you can still protect your personal assets from collection. The key is ensuring that your valuable assets are not held in your own name when a judgment creditor comes looking. This is where irrevocable trusts become essential.

What Is an Irrevocable Trust?

An irrevocable trust is a legal entity separate from you. Unlike a revocable trust (which you can change or dissolve and which offers no creditor protection), an irrevocable trust permanently transfers assets outside of your personal ownership. Once assets are in the trust, you no longer own them—the trust does, managed by a trustee according to terms you set at creation.

This is the critical distinction: a judgment against you personally cannot reach assets you don’t own. If your home, investments, and other wealth are held in a properly structured irrevocable trust, a wage and hour judgment creditor has nothing to collect from—even though you remain personally liable on paper.

Types of Irrevocable Trusts for Restaurant Owners

Domestic Asset Protection Trusts (DAPTs) are particularly powerful for restaurant owners. These “self-settled” trusts allow you to be a beneficiary of your own trust while still enjoying creditor protection. They’re available in states like Nevada, Delaware, and South Dakota, and New York residents can use them by establishing the trust in one of those jurisdictions with a local trustee.

Dynasty Trusts protect assets across generations. If you’ve built something you want to last—and you want to protect it from your children’s potential creditors, divorces, or poor decisions—a dynasty trust can hold family wealth for generations while providing distributions to family members.

Spendthrift Trusts include provisions that prevent beneficiaries’ creditors from reaching trust assets. Even if a beneficiary faces their own legal troubles, the trust assets remain protected.

Building the Complete Protection Structure

The most effective protection combines an irrevocable trust with proper entity structuring. Here’s how the pieces fit together:

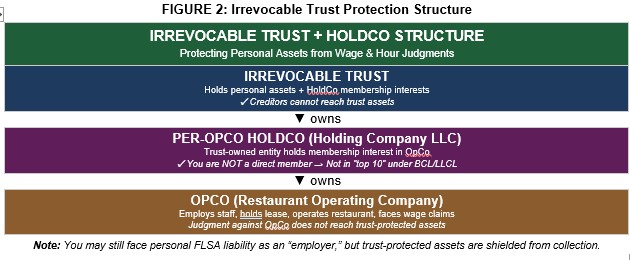

Layer 1: The Irrevocable Trust

Your personal assets—real estate, investment accounts, cash reserves, life insurance policies—are transferred into an irrevocable trust. Because you no longer own these assets, a wage judgment creditor cannot execute against them. The trust is managed by a trustee (not you) according to terms you set when the trust was created, which can include making distributions to you or your family under specified circumstances.

Layer 2: The Holding Company (Per-OpCo HoldCo)

If you’ve read my other articles on entity structuring, you know I recommend a per-OpCo HoldCo structure for multi-unit operators: each restaurant’s operating company (OpCo) is owned by a separate holding entity (HoldCo), and the principals own interests in that HoldCo rather than directly in the OpCo. This breaks the chain that BCL § 630 and LLCL § 609(c) use to reach you: you are no longer among the “top ten” direct shareholders or members of the operating entity.

Now take it one step further: have the irrevocable trust own your HoldCo interests. The trust—not you—is the member of the HoldCo. Judgment creditors cannot reach trust assets, and you’re removed from the statutory liability chain at both the OpCo and HoldCo levels.

Layer 3: The Operating Company (OpCo)

Your restaurant continues to operate through its OpCo—the LLC or corporation that employs staff, holds the lease, signs vendor contracts, and faces wage claims. Judgments against the OpCo—or against you personally as an “employer” under the FLSA—cannot reach the trust-protected assets above. The OpCo sits at the bottom of the structure, insulated from your personal wealth.

Important: This structure does not prevent you from being found personally liable under the FLSA’s “employer” definition if you continue to exercise operational control. What it does is ensure that when a judgment creditor tries to collect on that liability, your valuable assets are beyond their reach.

What Assets to Transfer

Not everything needs to go into a trust. The goal is to protect assets that represent your long-term wealth and family security—assets you don’t need to access daily for business operations.

For most restaurant owners, the priority assets are: (1) the family home, (2) investment and retirement accounts, and (3) ownership interests in any businesses outside the restaurant. These represent years of work and family security—exactly what a judgment creditor will target.

The Critical Importance of Timing

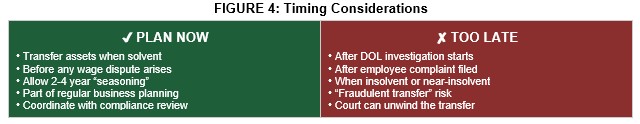

Here’s where many restaurant owners make a fatal mistake: they wait until a wage claim arises to think about asset protection. By then, it’s too late.

Both federal and state law include “fraudulent transfer” rules that allow creditors to unwind asset transfers made with the intent to hinder, delay, or defraud them. If you transfer assets to a trust after an employee complaint, after a DOL investigation starts, or even after circumstances that make a claim likely—a court may set aside the transfer and allow the creditor to reach those assets anyway.

The time to establish an irrevocable trust is when things are going well. You need to be solvent when you make the transfer, and ideally, there should be no pending or threatened claims. Many states have “seasoning” periods—typically two to four years—after which transferred assets become much harder for creditors to reach.

How to Set This Up

Setting up an irrevocable trust requires coordination between your hospitality attorney, estate planning counsel, and accountant. Here’s the typical process:

- Assess your exposure. Identify potential wage and hour vulnerabilities and quantify the risk. This determines how much protection you need.

- Map your assets. Identify what you own, how it’s titled, and what should be protected.

- Select the right trust structure. Based on your goals, this might be a DAPT in Nevada or Delaware, a dynasty trust, or another structure. Jurisdiction matters.

- Appoint a trustee. You cannot be the trustee of your own irrevocable trust if you want creditor protection. You’ll need a trusted individual or professional trustee.

- Execute the transfers properly. Each asset must be formally transferred—deeds for real estate, assignments for LLC interests, re-titling for accounts. Incomplete transfers defeat the purpose.

- Restructure ownership if needed. If you don’t already have a per-OpCo HoldCo structure, consider implementing one. Have the trust own your HoldCo interests rather than you owning OpCo interests directly.

- Maintain the structure. The trust must be properly administered with clear records and compliance with formalities.

Conclusion

Wage and hour liability is the single largest source of personal exposure for New York restaurant owners, and your LLC or corporation provides no protection. But an irrevocable trust—properly structured and funded before any claim arises—ensures that even when liability is imposed, your family’s wealth remains beyond the reach of judgment creditors.

The key is acting now, while business is good and there are no pending claims. Once a dispute arises, it’s too late to protect assets without risking fraudulent transfer challenges. The restaurant owners who are best protected are those who build their trust structure proactively and let it season over time.

If you haven’t thought about how your personal assets are structured—or if you’re relying on your LLC to protect you from wage claims—now is the time for a conversation. We can help you understand your exposure and coordinate with estate planning counsel to build a protection strategy that works.

About the Author

Andreas Koutsoudakis is a Partner and Co-Chair of the Hospitality & Restaurant Law Group at Davidoff Hutcher & Citron LLP. A litigator with deep roots in the restaurant industry, Andreas represents restaurant owners in complex commercial and partnership disputes, employment claims, and restructuring matters. He works closely with DHC’s Trusts & Estates Practice Group to help clients implement comprehensive asset protection strategies. He can be reached at aak@dhclegal.com.

This article is for informational purposes only and does not constitute legal advice. Asset protection planning involves complex legal and tax considerations, and you should consult with qualified counsel to evaluate your specific situation.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.