How Chapter 11 Can Resolve Your Personal Guarantees and EIDL Loans

By Andreas Koutsoudakis, Partner |

A Practical Playbook for NYC Restaurant Owners Seeking Relief

If you’re a restaurant owner in New York carrying COVID-era EIDL debt and personal guarantees that feel impossible to pay, I have good news: there are real, practical pathways to resolve these obligations—often for far less than you owe, and sometimes with complete forgiveness. The key is understanding how Chapter 11 bankruptcy can serve as a powerful platform for negotiating relief on both your business debts and your personal exposure.

Too many restaurant owners believe that business bankruptcy only helps the company—leaving them personally on the hook for every guarantee they signed. That’s not the whole story. When structured correctly, a business Chapter 11 can create the leverage, timeline, and negotiating framework to resolve your personal guarantees alongside the company’s debts. Let me show you how.

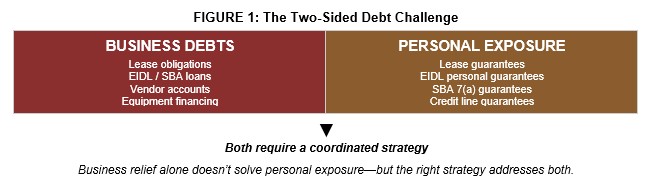

The Two-Sided Problem Every Restaurant Owner Faces

Most New York restaurant deals are built on personal signatures. Landlords require lease guarantees. Banks require personal guarantees on lines of credit. And the SBA required personal guarantees on every EIDL loan over $200,000. When the business struggles, you’re not just worried about the restaurant’s balance sheet—you’re worried about your own.

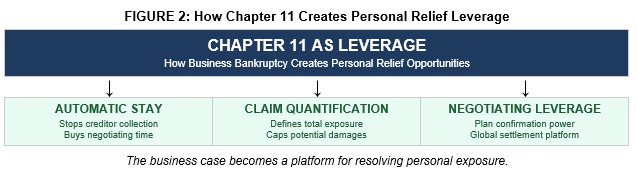

How Chapter 11 Creates Leverage for Personal Relief

Here’s what many owners don’t realize: filing Chapter 11 for your restaurant doesn’t just protect the business—it fundamentally changes the negotiating dynamics with every creditor, including those holding your personal guarantees.

The Automatic Stay Buys Time

The moment the business files, an automatic stay stops most collection actions against the company. While this doesn’t directly protect you personally, it creates breathing room. Creditors can’t simultaneously pursue the business and you—and most prefer to wait and see what the business case produces before spending money chasing personal guarantees.

Claims Get Quantified and Capped

In bankruptcy, creditors must file proofs of claim. This forces everyone to put their cards on the table. For personal guarantee purposes, this is valuable: you now know the exact amount you’re potentially liable for, and in many cases, the bankruptcy process itself reduces the underlying claim (for example, through lease rejection caps under Section 502(b)(6)), which directly reduces your guarantee exposure.

The Plan Becomes a Settlement Platform

The real power comes during plan confirmation. Creditors want to get paid and move on. If your plan offers a reasonable recovery on their claims against the business, many will agree to release your personal guarantee as part of a global settlement. Why? Because chasing you personally costs money, takes time, and may produce little additional recovery. A negotiated release—even without full payment—is often the rational choice.

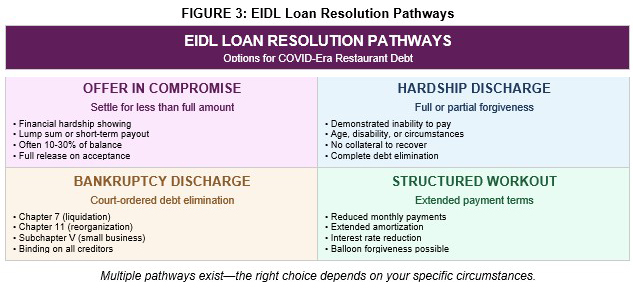

EIDL Loans: Real Pathways to Relief

Let’s talk specifically about EIDL loans—the COVID-era disaster loans that many restaurant owners took to survive the pandemic. These loans came with low interest rates and long terms, but they also came with personal guarantees for any owner with 20% or more equity. Now, years later, many restaurants can’t service this debt alongside their other obligations.

The good news: the SBA has established programs specifically designed to resolve EIDL debt, and bankruptcy can make these programs even more accessible.

The SBA Offer in Compromise

The SBA has an established Offer in Compromise (OIC) program that allows borrowers to settle EIDL debt for less than the full amount owed. In my experience, successful OIC settlements often resolve debt at 10-30 cents on the dollar, depending on the borrower’s financial situation and ability to pay. The key is demonstrating genuine financial hardship and presenting a reasonable settlement offer.

When a business is in Chapter 11, the OIC process becomes more straightforward. The bankruptcy filing itself demonstrates financial distress. The disclosure statement and plan provide a clear picture of what creditors—including the SBA—can expect to recover. This makes it easier to negotiate a settlement that the SBA will accept.

Hardship Discharge

In cases of genuine inability to pay—whether due to age, disability, business failure with no remaining assets, or other circumstances—the SBA may agree to a hardship discharge that forgives the debt entirely. This isn’t automatic, but it’s a real option that’s worth pursuing when the facts support it.

Bankruptcy Discharge

If the business liquidates and you need personal relief, EIDL debt (including your personal guarantee) can be discharged in a personal bankruptcy. This is a more aggressive option, but for owners facing overwhelming debt with no realistic path to repayment, it provides a clean slate. Importantly, EIDL debt is not treated as a priority tax debt or student loan—it’s dischargeable in bankruptcy like other unsecured debt.

An Integrated Strategy That Works

The most successful outcomes I’ve seen come from treating the business restructuring and personal guarantee resolution as one integrated project—not two separate problems.

Step 1: Map Everything

Before filing anything, create a complete picture of both business debts and personal guarantees. Which guarantees are limited in scope or amount? Which are unlimited? What collateral secures each obligation? What are the realistic collection risks if nothing is done? This assessment drives every subsequent decision.

Step 2: Stabilize with Chapter 11

File Chapter 11 (or Subchapter V for smaller cases) for the business. This creates the automatic stay, stops the bleeding, and establishes a structured process for dealing with creditors. For most restaurant cases, Subchapter V is particularly attractive—it’s faster, cheaper, and designed for businesses with debt under $7.5 million.

Step 3: Negotiate Globally

Use the plan process to negotiate with creditors on all fronts. Landlords may release guarantees in exchange for lease assumptions on modified terms. Lenders may accept reduced payouts in exchange for guarantee releases. The SBA may agree to an Offer in Compromise as part of the plan. The goal is a global resolution that addresses both business and personal exposure in one coordinated effort.

Step 4: Confirm and Close

A confirmed Chapter 11 plan with negotiated guarantee releases provides certainty and finality. Creditors who agree to the plan are bound by it. You emerge with a restructured business (if continuing operations) or a clean wind-down (if liquidating), and—critically—resolved personal guarantee exposure.

What Makes This Work

I’ve helped restaurant owners resolve personal guarantees and EIDL obligations through this process many times. The owners who achieve the best outcomes share a few characteristics:

They act early. The best leverage exists before defaults cascade, before creditors start litigation, and before options narrow. If you’re reading this and worrying about your EIDL debt or personal guarantees, now is the time to explore your options—not six months from now.

They think holistically. The restaurant’s future and your personal financial future are connected. A strategy that saves the business but leaves you drowning in personal guarantee debt isn’t a success. Everything needs to be planned together.

They get the right help. Restaurant restructuring requires lawyers who understand both bankruptcy and the restaurant industry. Generic bankruptcy counsel may miss opportunities that someone who knows how landlords, lenders, and the SBA actually behave in restaurant cases would catch.

Conclusion: There Is a Way Forward

If you’re carrying EIDL debt, lease guarantees, or other personal guarantee exposure that feels overwhelming, know this: these obligations can be resolved. Chapter 11 isn’t just a tool for saving businesses—it’s a platform for negotiating comprehensive relief that includes your personal guarantees. The SBA has programs specifically designed to compromise EIDL debt. And creditors, when faced with the reality of a bankruptcy case, often prefer negotiated settlements to expensive, uncertain collection efforts.

The worst thing you can do is nothing—watching the debt compound while opportunities to negotiate slip away. The best thing you can do is build an integrated plan that addresses both sides of your balance sheet: the business and your personal exposure.

If you’re ready to explore your options, let’s talk.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.