Chapter 11 and Wage Claims, Part 3: Personal Liability & Claim Priority—The Piece Most Owners Miss

By Andreas Koutsoudakis, Partner |

In Parts 1 and 2, we covered the bar date strategy and the three resolution pathways. But here’s the critical piece many owners miss: the business’s Chapter 11 discharge does not automatically release your personal liability.

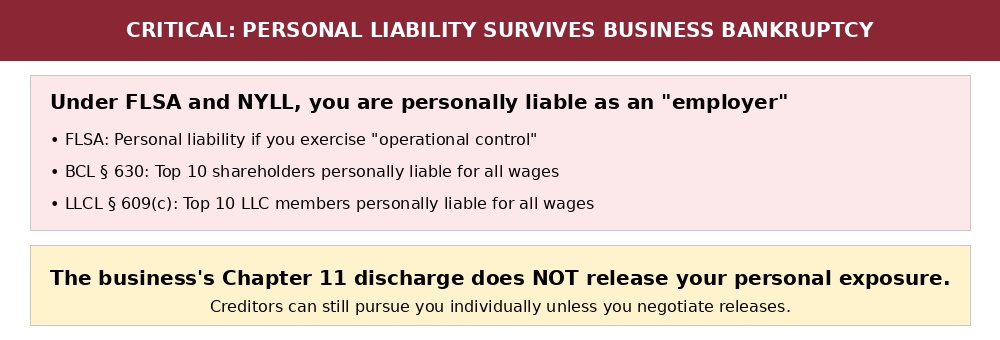

The Personal Liability Problem

FIGURE 1: Personal Liability Survives Business Bankruptcy

Under both FLSA and NYLL, you are personally liable as an “employer” if you exercised operational control. The automatic stay protects the debtor entity—not you. Creditors can still pursue you individually while the business case is pending, and a confirmed plan that discharges the business’s debts does not discharge your personal exposure.

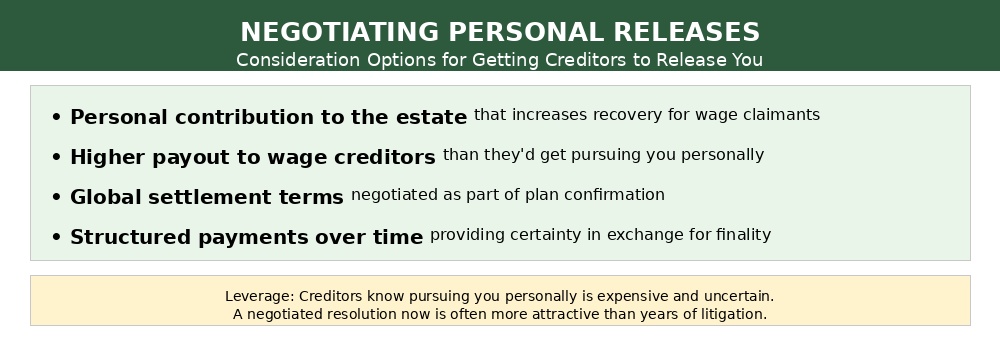

Negotiating Personal Releases

To achieve true finality, you need creditors to release your personal liability as part of the restructuring. This requires providing consideration—value in exchange for the release:

FIGURE 2: Negotiating Personal Releases

If releases can’t be negotiated: You may need to consider a coordinated personal bankruptcy alongside the business case. This requires careful planning with counsel who understands both business and individual bankruptcy.

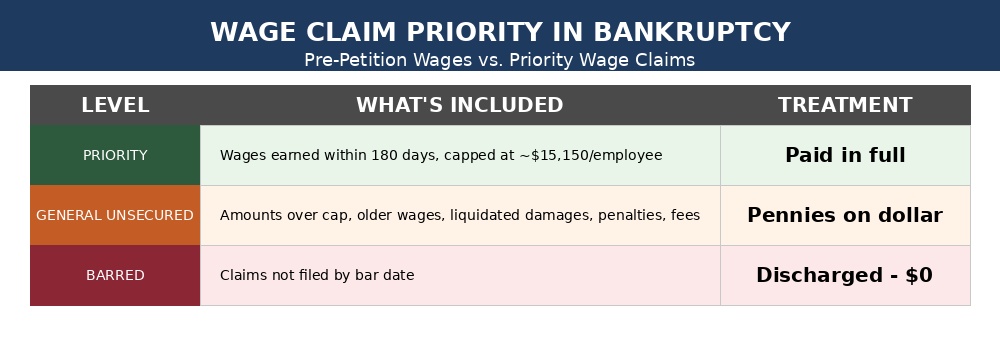

Understanding Claim Priority

Not all wage claims are treated equally. Understanding the distinction between pre-petition wages generally and priority wage claims specifically is crucial:

FIGURE 3: Wage Claim Priority

Example: A $500,000 wage claim might break down as $100,000 priority (paid in full) and $400,000 general unsecured. If the plan pays unsecured at 10%, your effective exposure drops from $500,000 to $140,000.

Bringing It All Together

- Bar date (Part 1) cuts off claims from employees who don’t file

- Resolution pathways (Part 2) provide options to exit clean

- Priority rules (Part 3) dramatically reduce effective claim values

- Personal releases (Part 3) require negotiation and consideration

The owners who achieve true finality address both sides—business debts and personal exposure—in a coordinated strategy. If wage claims are threatening your restaurant or your personal assets, let’s talk about whether Chapter 11 makes sense for your situation.

———————————————————————-

About the Author

Andreas Koutsoudakis is a Partner and Co-Chair of the Hospitality & Restaurant Law Group at Davidoff Hutcher & Citron LLP. He represents restaurant owners in complex commercial disputes, wage and hour defense, and restructuring matters. He works closely with DHC’s Bankruptcy Practice Group. He can be reached at aak@dhclegal.com.

This article is for informational purposes only and does not constitute legal advice.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.