Chapter 11 and Wage Claims, Part 2: Resolution Pathways—Three Ways to Emerge Clean

By Andreas Koutsoudakis, Partner |

In Part 1, we discussed how the bar date creates finality by cutting off claims from employees who don’t file by the deadline. But that’s just one piece of the puzzle. This article covers the three main pathways to resolve your wage exposure and exit Chapter 11.

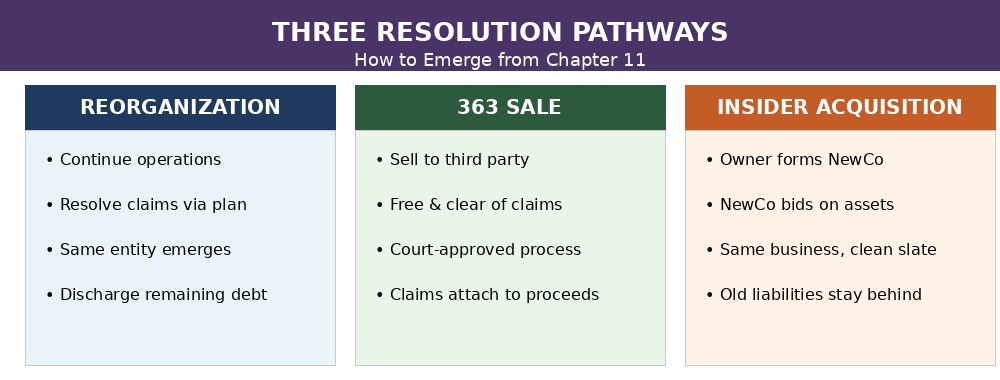

FIGURE 1: Three Resolution Pathways

Pathway 1: Plan of Reorganization

The traditional Chapter 11 route. You continue operating, propose a plan that pays creditors according to priority, and emerge with the same entity—but with pre-petition wage claims resolved and discharged.

Priority wage claims must be paid in full. But liquidated damages, penalties, attorneys’ fees, and amounts over the statutory cap become general unsecured—often paid at pennies on the dollar.

Pathway 2: Section 363 Sale (Free and Clear)

A 363 sale allows the debtor to sell assets free and clear of all liens, claims, and encumbrances—including wage claims. The buyer gets clean assets; the claims attach to the sale proceeds instead.

This is powerful for restaurant sales because the buyer can take over the location, equipment, and brand without inheriting wage liabilities. The court-approved sale order provides protection that an ordinary asset purchase cannot.

Pathway 3: Insider Acquisition (NewCo Structure)

Here’s what many owners don’t realize: you can be the buyer.

In a liquidating Chapter 11, the owner can form a new entity—NewCo—and bid on the debtor’s assets. If done properly, NewCo acquires the restaurant’s assets free and clear of the old entity’s liabilities.

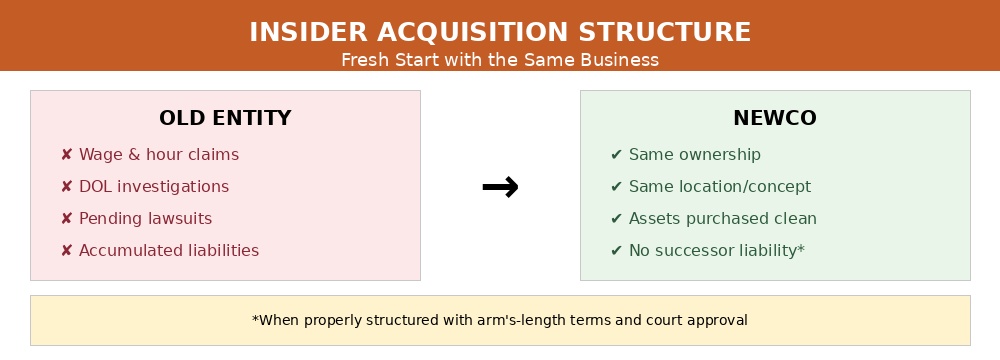

FIGURE 2: Insider Acquisition Structure

Caution: Courts scrutinize insider sales carefully. You must demonstrate arm’s-length terms, fair market value, and a transparent process. Attempts to “lowball” can result in the sale being unwound or successor liability being imposed on NewCo.

Which Pathway Is Right for You?

- Reorganization if you want to keep operating and your debt is manageable

- 363 Sale if there’s a third-party buyer willing to pay fair value

- Insider Acquisition if you want to restart clean but keep the business

Important: These pathways resolve claims against the business entity. Your personal liability under FLSA and NYLL requires separate attention—covered in Part 3.

About the Author

Andreas Koutsoudakis is a Partner and Co-Chair of the Hospitality & Restaurant Law Group at Davidoff Hutcher & Citron LLP. He can be reached at aak@dhclegal.com.

This article is for informational purposes only and does not constitute legal advice.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.