Chapter 11 and Wage Claims, Part 1: The Bar Date Strategy—Creating Finality for Your Entire Workforce

By Andreas Koutsoudakis, Partner |

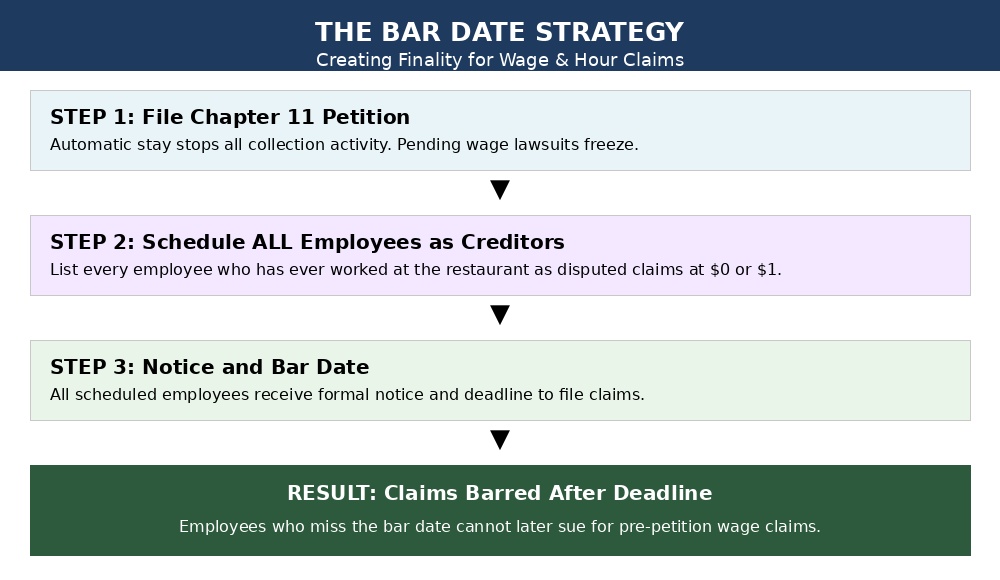

For New York restaurant owners drowning in wage and hour claims, Chapter 11 bankruptcy offers something that out-of-court settlements rarely can: finality.

I’ve seen restaurant owners pay six figures to settle wage claims—only to face new lawsuits from other workers months later. It feels like whack-a-mole with your life savings. Chapter 11 changes the game with one powerful tool: the bar date.

What Is the Bar Date?

The bar date is a court-ordered deadline by which all creditors must file their claims or lose them forever. Miss it, and you’re barred from asserting your claim against the debtor—period.

The Key Insight: Schedule Everyone

Here’s what many restaurant owners miss: you don’t just list employees involved in current lawsuits or DOL investigations. You list every employee who has ever worked at your restaurant as a creditor with a potential wage claim.

Why? Because every former employee is a potential plaintiff. Under FLSA and NYLL statutes of limitation, they could sue you for wage violations going back years. By scheduling them with a disputed claim at $0 or $1, you’re putting them on formal notice that:

- You have filed bankruptcy

- They are listed as a potential creditor

- You do not believe anything is owed to them

- They have until the bar date to file a proof of claim if they disagree

If they don’t file by the bar date—and most won’t, because most employees don’t have active disputes—they are forever barred from asserting a pre-petition wage claim against you.

Practical Implementation

To execute this strategy, you need complete employee records: names, last known addresses, dates of employment. This becomes your creditor matrix. Work with your payroll provider, accountant, and HR records to build as comprehensive a list as possible.

The court will set the bar date—typically 90 days after the meeting of creditors. All scheduled creditors receive formal notice by mail. After the bar date passes, any employee who didn’t file a claim has lost their right to assert one.

Important: This bars claims against the debtor entity. Your personal liability under FLSA and NYLL is a separate issue—addressed in Part 3 of this series.

Coming Up in This Series

- Part 2: Resolution Pathways—Reorganization, 363 Sales, and Insider Acquisitions

- Part 3: Personal Liability & Claim Priority—What the Business Bankruptcy Doesn’t Automatically Fix

—————————————————————————————-

About the Author

Andreas Koutsoudakis is a Partner and Co-Chair of the Hospitality & Restaurant Law Group at Davidoff Hutcher & Citron LLP. He represents restaurant owners in complex commercial disputes, wage and hour defense, and restructuring matters. He can be reached at aak@dhclegal.com.

This article is for informational purposes only and does not constitute legal advice.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.