Building a Bulletproof Entity Structure for Your Multi-Unit Restaurant Group

By Andreas Koutsoudakis, Partner |

A Practical Framework for NYC Restaurant Owners

Growing a restaurant group in New York isn’t just about finding the next great location or perfecting your menu. It’s about building a legal foundation that protects what you’ve already built while giving you room to grow. Entity structure isn’t paperwork—it’s the backbone of risk management, capitalization, and exit optionality.

I’ve spent my career advising restaurant owners on how to structure their businesses for the long haul. Below, I walk through a practical, New York–focused framework that integrates operating companies, centralized management, IP protection, and—for those serious about growth and succession—separate holding entities for each location to maximize liability siloing and estate planning flexibility.

The Starting Question: One Entity or One Per Location?

When you open your first restaurant, a single LLC makes sense. But once you’re thinking about location two, three, or beyond, you face a fundamental choice: keep everything under one roof, or form a new entity for each unit. This decision affects your liability exposure, financing flexibility, taxes, and your ability to sell or spin off individual locations down the road.

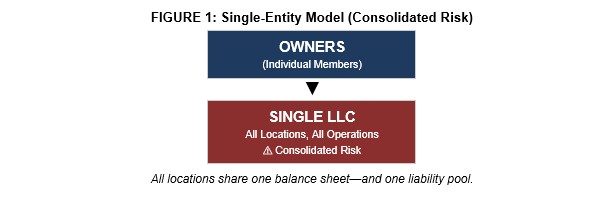

The Single-Entity Model: Simple, But Risky

Under a single-entity model, all your locations operate under one LLC or corporation. You have one set of books, one tax return, and one entity to manage. It’s administratively simple and keeps legal costs down—at first.

The problem? A major lawsuit at your Midtown location can put your profitable Brooklyn spot at risk. A lease dispute in one neighborhood could jeopardize the whole portfolio. And if you ever want to sell just one restaurant, you’re in for a messy asset sale instead of a clean entity transfer.

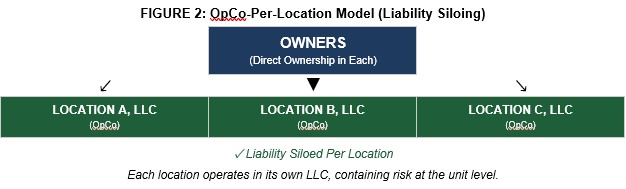

One LLC Per Location (The OpCo-by-Unit Approach)

For most multi-unit operators I work with, the better answer is forming a separate operating company (“OpCo”) for each location. Location A, LLC runs your first spot. Location B, LLC runs the second. And so on.

Yes, you’ll have more entities to maintain, more tax returns to file, and slightly higher administrative costs. But the benefits are substantial: a lawsuit at one location doesn’t threaten the others, you can bring in investors or sell off a single unit cleanly, and your financial reporting is naturally organized by site.

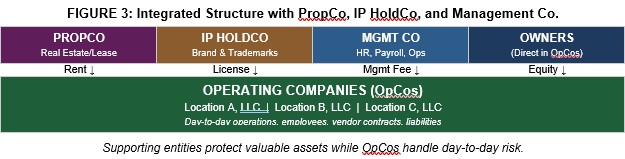

The Building Blocks: PropCo, IP HoldCo, and Management Company

Once you move beyond the basic OpCo structure, there are additional layers that can protect your most valuable assets and create operational efficiencies.

PropCo: Separating Real Estate from Operations

If you own the real estate or hold a master lease, consider placing it in a separate property company (“PropCo”). The PropCo owns the building or lease and rents to the OpCo at arm’s length. This keeps your real estate insulated from operating-level liabilities and creates a clean rent stream.

IP HoldCo: Protecting Your Brand

Your restaurant name, logo, and proprietary recipes are often your most valuable assets—but they’re also vulnerable if they sit inside an operating company that takes on day-to-day liabilities. An IP holding company owns your trademarks and licenses them to each OpCo for a royalty fee. The brand stays protected even if an individual location runs into trouble.

Management Company: Centralizing Operations

A centralized management company can handle payroll, HR, purchasing, marketing, and accounting for all your locations. It charges each OpCo an arm’s-length management fee. This structure is particularly valuable when you have partners or investors at different levels—higher-level principals can own interests in the management company and participate in profits across the group, even if individual locations have different ownership mixes.

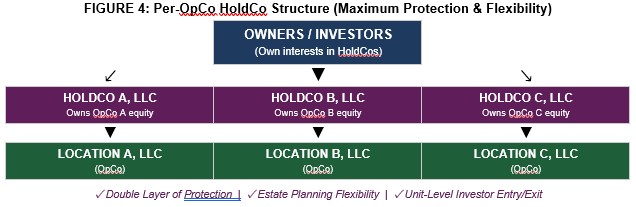

The Advanced Layer: A Separate HoldCo for Each OpCo

Here’s where sophisticated operators can take their structure to the next level. Instead of owning your OpCo equity directly, you form a separate holding company (“HoldCo”) for each operating company. The HoldCo owns 100% of the OpCo, and you and your partners own interests in the HoldCo.

Why bother with this extra layer? Several compelling reasons:

Enhanced liability siloing at the equity level. Your ownership interest in one location is insulated within its HoldCo, reducing the chance that claims at another location bleed through.

Estate planning flexibility. You can gift, sell, or transfer interests at the HoldCo level on a per-location basis. Want to give your son a piece of the Brooklyn restaurant while keeping Times Square for yourself? Easy to do when each location has its own HoldCo.

Investor entry and exit. Admit or redeem investors at the HoldCo level without disturbing the OpCo’s day-to-day operations. Facilitate unit-specific sales or secondary transactions.

Governance clarity. Each HoldCo can have its own operating agreement reflecting deal-specific economics, waterfall terms, and investor rights—without forcing a one-size-fits-all regime across the group.

Transaction readiness. Want to sell one location? Sell the HoldCo. The buyer gets clean OpCo equity without you having to re-paper your entire corporate structure.

Is this layer mandatory? No. The per-OpCo HoldCo structure is optional and can be phased in for new locations or implemented during a recapitalization of existing ones. But for groups targeting growth, third-party capital, or succession planning, I strongly recommend it. The additional administrative cost is modest compared to the flexibility and protection you gain.

New York Reality Check: Lenders, Landlords, and Guarantees

No structure exists in a vacuum. In the real world, New York landlords and lenders have their own requirements that can complicate your plans:

Landlords often want a “real” operating entity on the lease, plus personal guarantees from the principals. Some will insist on cross-guarantees across multiple locations.

Lenders may prefer lending to a central entity or, conversely, to specific locations with distinct collateral packages. Cross-default and cross-collateralization provisions can undermine your multi-entity benefits if not negotiated carefully.

The key is negotiating these terms at the outset. Push back on blanket cross-defaults. Limit personal guarantee exposure where possible. Calibrate your structure to avoid entanglements that defeat the purpose of liability siloing.

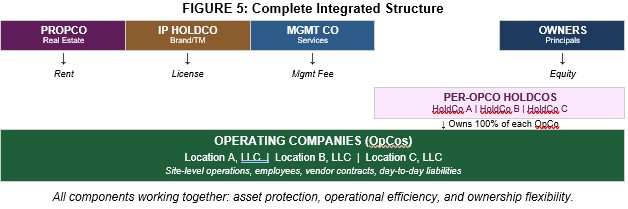

Putting It All Together: The Complete Framework

Here’s how all the pieces fit into a comprehensive, scalable structure:

A Scalable Playbook for NYC Operators

Form an OpCo for each location. This is the foundation. Pair with PropCo if you control the real estate, and have IP HoldCo license brand assets to each OpCo.

Stand up a centralized management company. Charge arm’s-length management fees for payroll, HR, purchasing, marketing, and accounting.

For each OpCo, create a separate HoldCo. Admit owners and investors at the HoldCo level, not directly into the OpCo.

Calibrate guarantees and covenants. Negotiate with landlords and lenders to avoid cross-entity entanglements that defeat your siloing.

Maintain intercompany discipline. Keep leases, license agreements, management contracts, and distribution policies current and properly documented.

Conclusion

For multi-unit NYC restaurant operators, entity structure is a strategic decision with real consequences. Done well, it protects your stronger locations from weaker ones, simplifies future sales, and improves your financing options. Done poorly, one bad lease or lawsuit can jeopardize everything you’ve built.

The per-OpCo HoldCo layer is optional—but for operators serious about growth and succession in New York, it’s strongly recommended. To tailor this structure to your specific portfolio, we should review your leases, financing documents, and current cap table, then implement a phased roadmap with clear governance, tax alignment, and intercompany discipline.

If you’re ready to build a structure that scales with your ambitions, let’s talk.

Meet the Author

Andreas Koutsoudakis is a Partner, litigation attorney, and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron’s New York City office.

With extensive experience as a litigator and trusted legal advisor, Andreas represents business owners, executives, and entrepreneurs in complex commercial disputes, business divorces, and employment-related litigation. As the Partner and Co-Chair of Hospitality & Restaurant Law at Davidoff Hutcher & Citron LLP, he uses his in-depth industry knowledge to provide strategic legal solutions for businesses navigating high-stakes disputes, regulatory challenges, and internal conflicts among partners, shareholders, and LLC members.